IRS Claims Hipster Owes $172 Million

Agency files huge lien against ex-Alphabet City man

AUGUST 24--The Internal Revenue Service claims that a Spanish émigré who once lived in a New York City tenement owes it $172 million in back taxes.

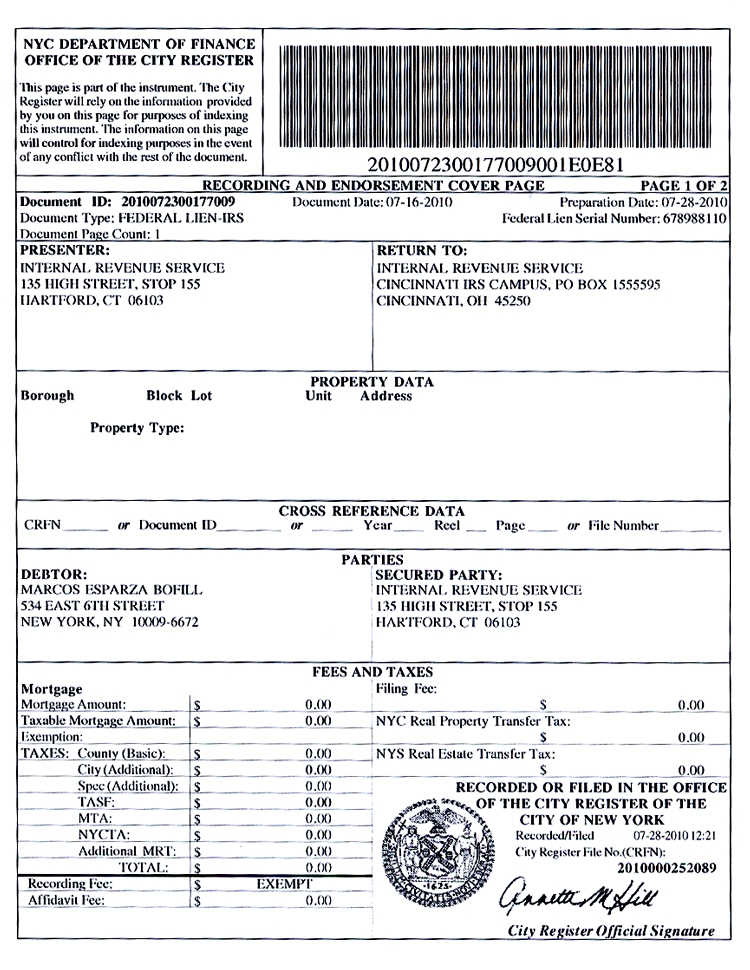

The federal tax lien was filed last month against Marcos Esparza Bofill, who the IRS claims owes it nine figures in connection with his 2006 tax return. According to the lien, the former Alphabet City resident owes exactly $172,101,056.48.

Esparza Bofill, a garage music fan who came to New York to try his hand as a day trader, has since returned to Barcelona. While he declined  TSG interview requests, a friend said that Esparza Bofill was puzzled by the gargantuan lien. Adam Baruchowitz, who once operated a web site with Esparza Bofill, said that his friend returned to Spain after his day trading proved unsuccessful.

TSG interview requests, a friend said that Esparza Bofill was puzzled by the gargantuan lien. Adam Baruchowitz, who once operated a web site with Esparza Bofill, said that his friend returned to Spain after his day trading proved unsuccessful.

Baruchowitz said that Esparza Bofill has recently spoken to him about the prospect of returning to the U.S. and working for Wearable Collections, Baruchowitz’s clothing recycling business. “He’s worried that they won’t let him in the country over this,” said Baruchowitz, himself a former day trader.

Since the IRS does not comment about individual taxpayers, it is unclear how they arrived at the $172 million figure (or whether it is a massive screw-up on the agency’s part). To owe the federal government that much, an individual would have to earn roughly $500 million in a single calendar year.

Additionally, it is unknown what kind of an effect the IRS lien might have on Esparza Bofill’s credit rating. Well, actually, that’s not true. (2 pages)

Comments (7)